Introduction: Why Mortgage Rates Matter More Than Ever

Mortgage rates have always played a critical role in determining the cost of homeownership, but in 2025, they’ve become an even bigger factor in personal financial planning. With housing prices fluctuating and the economy shifting, the difference between a good rate and a great rate could mean saving thousands of dollars over the life of your loan.

In this guide, we’ll break down the current mortgage rate landscape, explore the factors influencing rates in 2025, and give you actionable strategies to secure the lowest possible interest rate. You’ll also find real-world examples, lender comparisons, and expert tips to make informed decisions. Whether you’re a first-time homebuyer, refinancing, or investing in real estate, understanding mortgage rates is essential to maximizing your financial advantage.

Section 1: Understanding Mortgage Rates in 2025

1.1 What Are Mortgage Rates and How Do They Work?

Mortgage rates represent the interest you’ll pay on your home loan, expressed as a percentage. For example, a 6.2% fixed mortgage rate means you’ll pay 6.2% interest annually on the remaining loan balance. This rate determines how much of your monthly payment goes toward interest versus principal.

In 2025, rates are influenced by both macroeconomic conditions and individual borrower profiles. While the Federal Reserve’s monetary policy heavily impacts rates, so do your credit score, down payment amount, and debt-to-income ratio. Knowing these components helps you negotiate better with lenders.

Key factors influencing rates:

-

Economic indicators – inflation, GDP growth, employment levels

-

Federal Reserve policy – interest rate adjustments

-

Bond market performance – especially 10-year Treasury yields

-

Lender competition – some banks offer lower rates to attract borrowers

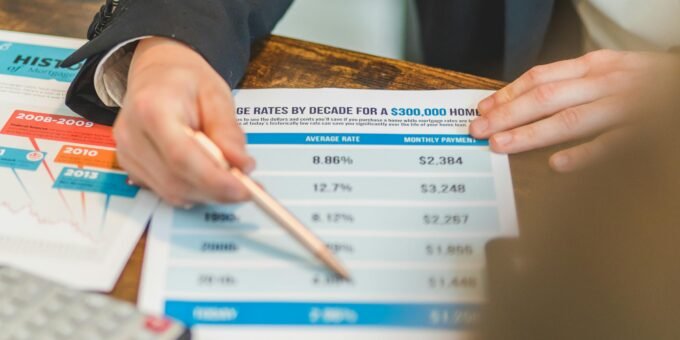

1.2 Historical Trends Leading to 2025

Mortgage rates have gone through significant cycles in recent decades. In 2020–2021, rates hit record lows due to pandemic-related economic measures. By 2023–2024, inflationary pressures pushed them higher, peaking above 7% for some loan types.

Entering 2025, analysts predict more stability, with rates hovering between 5.5% and 6.8% depending on the loan type. Understanding this historical context helps buyers decide whether to lock a rate now or wait for potential drops.

Table: Average Mortgage Rates Over the Last 5 Years

| Year | 30-Year Fixed | 15-Year Fixed | 5/1 ARM |

|---|---|---|---|

| 2021 | 2.96% | 2.26% | 2.50% |

| 2022 | 4.45% | 3.80% | 3.90% |

| 2023 | 6.12% | 5.30% | 5.50% |

| 2024 | 6.85% | 6.12% | 6.25% |

| 2025* | 5.90%–6.50% | 5.25%–5.75% | 5.60%–6.10% |

(*Estimated averages as of Q1 2025)

Section 2: Factors That Affect Mortgage Rates

2.1 Personal Financial Profile

Your personal creditworthiness is one of the biggest rate determinants. Lenders reward borrowers with strong credit, stable income, and low debt loads by offering them better rates.

Ways your profile impacts rates:

-

Credit score – A score above 740 typically qualifies for the best rates

-

Debt-to-income ratio (DTI) – The lower, the better; under 36% is ideal

-

Loan-to-value ratio (LTV) – Putting 20% down reduces lender risk

-

Employment stability – Consistent work history shows reliability

2.2 Market & Economic Conditions

Even if you have perfect credit, market forces can move rates up or down. Mortgage rates tend to rise when inflation is high or when the economy is growing quickly, and fall during economic slowdowns.

Economic triggers for rate changes:

-

Federal Reserve interest rate decisions

-

Consumer price index (CPI) reports

-

Stock and bond market fluctuations

-

Geopolitical events impacting investor confidence

Section 3: Strategies to Secure the Best Mortgage Rates in 2025

3.1 Improve Your Credit Before Applying

If your credit score isn’t in the “excellent” range, small improvements can translate into thousands in savings. Start by checking your credit report for errors, paying down high-interest debts, and avoiding new credit inquiries before applying.

Quick credit improvement tips:

-

Pay bills on time every month

-

Keep credit utilization below 30%

-

Avoid applying for new loans or credit cards

-

Dispute any errors on your credit report

3.2 Shop Around and Compare Lenders

Different lenders offer different rates even to borrowers with identical profiles. In 2025, online mortgage marketplaces make it easier than ever to compare offers side-by-side.

Example lender comparison:

| Lender | 30-Year Fixed | 15-Year Fixed | Fees & Closing Costs |

|---|---|---|---|

| Bank A | 5.95% | 5.25% | $3,200 |

| Bank B | 6.05% | 5.35% | $2,800 |

| Online Lender X | 5.85% | 5.20% | $3,000 |

Section 4: Special Mortgage Programs in 2025

4.1 Government-Backed Loans

Government programs often provide more competitive rates, especially for first-time buyers or those with lower credit scores.

-

FHA Loans – Low down payment (3.5%) and flexible credit requirements

-

VA Loans – No down payment for veterans and service members

-

USDA Loans – For rural and suburban homebuyers with low-to-moderate income

4.2 Rate Lock and Buydown Options

In a fluctuating market, locking in your rate can protect you from sudden increases. Some lenders also offer buydown programs, where you pay extra upfront to secure a lower rate for the first few years.

Section 5: Common Mistakes to Avoid

5.1 Waiting Too Long to Lock Your Rate

Hoping rates will drop can be risky. If market indicators point to an increase, locking early may save you money.

5.2 Ignoring All-in Costs

A low interest rate with high closing costs may not be the best deal. Always calculate the total cost of the loan over its full term.

Conclusion: Take Action for the Best Deal

Securing the best mortgage rates in 2025 requires preparation, comparison, and timely action. By improving your financial profile, researching multiple lenders, and understanding market conditions, you can position yourself for significant savings.

Now it’s your turn—are you planning to buy or refinance this year? Share your thoughts, experiences, or questions in the comments so we can help each other make smarter mortgage decisions.