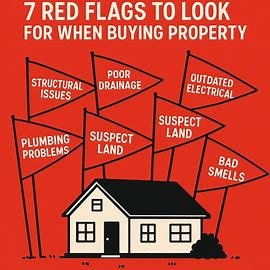

7 Red Flags to Look for When Buying Property

Purchasing a property is one of the most significant investments you will make in your lifetime. While the process can be exciting, it also comes with potential pitfalls that can lead to costly mistakes. To protect yourself and your investment, it’s crucial to recognize warning signs before making an offer. In this comprehensive guide, we will outline seven major red flags when buying property, explain why they matter, and provide actionable tips to avoid these issues.

1. Unrealistic Pricing

Pricing is one of the first things that attracts or repels potential buyers. However, an unusually high or low price should raise suspicion.

Why It’s a Red Flag

- Overpriced properties often indicate sellers who are not motivated or are testing the market. This can lead to extended negotiations and wasted time.

- Underpriced properties can be a sign of hidden issues such as structural damage, legal disputes, or unpaid taxes.

How to Spot Unrealistic Pricing

- Compare the property price to similar homes in the neighborhood.

- Use property valuation tools and consult real estate agents for expert advice.

- Ask for recent sale prices of comparable properties (known as “comps”).

Example:

| Property Type | Location | Market Price | Listed Price |

|---|---|---|---|

| 3-Bedroom | Suburban | $400,000 | $290,000 |

A $110,000 difference is a potential red flag that warrants further investigation.

2. Structural Issues

The condition of the property’s structure directly impacts its safety and longevity. Ignoring structural problems can lead to massive repair costs in the future.

Common Structural Problems

- Foundation cracks

- Uneven floors

- Roof leaks or sagging

- Water damage on ceilings and walls

Why Structural Issues Matter

- Repairs can cost thousands of dollars.

- They may compromise the overall safety of the property.

- Structural damage can reduce property value and make it harder to sell later.

How to Detect Them

- Hire a professional home inspector.

- Check for visible cracks, mold, and unusual smells.

- Pay attention to doors and windows that don’t close properly – a sign of shifting foundations.

Tip: Always insist on a full structural survey, especially for older properties.

3. Legal and Ownership Disputes

Before signing any contract, confirm that the property has a clean legal status. Ignoring this step could lead to years of legal battles.

Why Legal Clarity Is Important

- Properties with unclear titles can be repossessed.

- Disputes with previous owners or family heirs can delay or cancel transactions.

Red Flags to Watch For

- Incomplete or missing property documentation

- Pending litigation on the property

- Multiple owners without clear consent

How to Avoid Legal Pitfalls

- Request a copy of the title deed.

- Conduct a title search through a legal professional.

- Ensure all taxes and dues are cleared.

Pro Tip: Always work with a qualified real estate attorney for documentation verification.

4. Poor Location and Neighborhood Issues

Location is a key factor in property valuation. A bad neighborhood or inconvenient location can impact your quality of life and resale value.

Key Location Concerns

- High crime rate

- Lack of public transportation

- Poor access to schools, hospitals, and grocery stores

- Future development plans that could lower property value

How to Research the Neighborhood

- Visit the area at different times of the day.

- Check local crime statistics.

- Talk to neighbors for honest opinions.

- Review zoning laws and planned infrastructure projects.

Example Checklist:

5. Unusually High or Hidden Maintenance Costs

A property that looks perfect on the surface may come with high maintenance expenses. Hidden costs can make ownership financially burdensome.

Common Hidden Costs

- Outdated plumbing and wiring

- Pest infestations

- HOA fees in gated communities

How to Identify Them

- Ask for utility bills and maintenance history.

- Check age of major systems like HVAC, plumbing, and roof.

- Inquire about Homeowners Association rules and fees.

Tip: Include a clause in the contract allowing you to withdraw if unexpected costs arise during inspection.

6. Signs of Water Damage and Poor Drainage

Water issues can cause long-term damage, mold growth, and health risks.

What to Look For

- Mold or mildew smell

- Stains on ceilings or walls

- Pools of water in the basement or yard

Why This Is Serious

- Structural damage from rot

- Health issues from mold exposure

- Decreased property value

Prevention

- Check gutters and drainage systems.

- Inspect the basement for leaks.

- Hire an inspector to assess moisture levels.

7. Uncooperative Seller or Agent

The attitude and transparency of the seller or agent can indicate hidden issues.

Warning Signs

- Refusing property inspections

- Providing incomplete or inconsistent information

- Pressuring for a quick sale without negotiations

Why It Matters

- A lack of transparency often hides major property issues.

- High-pressure tactics may lead you to skip due diligence.

What to Do

- Walk away if the seller resists inspections.

- Get everything in writing.

- Work with a trusted real estate agent who prioritizes your interests.

Conclusion: Stay Alert and Do Your Homework

Buying a property is a life-changing decision that demands careful research and attention to detail. By recognizing these seven red flags when buying property, you can avoid costly mistakes and make a confident purchase. Always prioritize thorough inspections, legal verification, and location analysis before committing.