Introduction

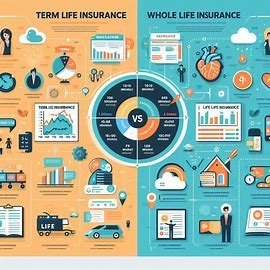

Life insurance is one of the most important financial tools you can have to protect your family’s future. But when you start shopping for coverage, one big question comes up almost immediately: Should you choose term life insurance or whole life insurance?

Both options have their pros and cons, and the right choice depends on your goals, budget, and financial strategy. In this comprehensive guide, we’ll break down term vs whole life insurance in detail so you can make an informed decision that works best for you.

1. Understanding the Basics of Life Insurance

Before diving into the differences between term and whole life insurance, it’s important to understand the core concept of life insurance.

1.1 What is Life Insurance?

Life insurance is a contract between you and an insurance company. In exchange for your premium payments, the insurer promises to pay a death benefit to your beneficiaries when you pass away.

Key purposes include:

-

Providing financial security for loved ones.

-

Covering debts and final expenses.

-

Supporting long-term estate planning.

1.2 The Two Main Categories

Life insurance generally falls into two broad categories:

-

Term Life Insurance: Coverage for a set number of years (e.g., 10, 20, or 30 years).

-

Permanent Life Insurance: Coverage that lasts your entire life, with whole life being the most common type.

2. What is Term Life Insurance?

Term life insurance is designed to provide affordable, straightforward coverage for a fixed period.

2.1 Key Features of Term Life

-

Coverage duration: Typically 10–30 years.

-

Premiums: Usually fixed for the term.

-

No cash value: Pure protection without investment components.

Best for:

People who want affordable coverage during high-need years, such as when raising children or paying off a mortgage.

2.2 Pros and Cons of Term Life

Pros:

-

Lower premiums compared to whole life.

-

Simple and easy to understand.

-

Ideal for temporary coverage needs.

Cons:

-

Coverage ends when the term expires.

-

No savings or cash value accumulation.

-

Renewal after the term can be expensive.

3. What is Whole Life Insurance?

Whole life insurance is a type of permanent coverage that lasts for your entire life, as long as premiums are paid.

3.1 Key Features of Whole Life

-

Lifetime coverage.

-

Fixed premiums.

-

Cash value component that grows over time.

Best for:

Individuals looking for lifelong protection and a savings element they can access during their lifetime.

3.2 Pros and Cons of Whole Life

Pros:

-

Guaranteed death benefit.

-

Cash value growth (tax-deferred).

-

Can borrow against the cash value.

Cons:

-

Higher premiums compared to term life.

-

More complex structure.

-

Lower investment returns compared to other options.

4. Term vs Whole Life Insurance: Side-by-Side Comparison

To better understand the difference, let’s look at a table comparing the two.

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Duration | Fixed term (10–30 years) | Lifetime |

| Premiums | Lower, fixed for term | Higher, fixed for life |

| Cash Value | None | Yes, grows over time |

| Best For | Temporary needs | Lifelong protection & savings |

| Flexibility | Limited | Can borrow against cash value |

5. Cost Comparison: Term vs Whole Life Insurance

5.1 Premium Differences

Term life insurance is significantly more affordable, especially for younger applicants.

Example:

A healthy 30-year-old male might pay:

-

Term Life (20 years, $500k coverage): ~$25/month.

-

Whole Life (lifetime, $500k coverage): ~$350/month.

5.2 Why the Cost Difference?

Whole life insurance premiums are higher because:

-

The policy is guaranteed to pay out eventually.

-

It includes a savings/investment component.

-

Premiums remain fixed for life.

6. Choosing the Right Option for Your Needs

6.1 When Term Life Makes Sense

-

You want the most coverage for the lowest cost.

-

Your primary concern is protecting dependents until they are financially independent.

-

You’re comfortable investing separately for retirement.

6.2 When Whole Life Makes Sense

-

You want permanent coverage.

-

You have long-term estate planning goals.

-

You prefer a forced savings mechanism.

7. Combining Term and Whole Life: A Blended Strategy

Some people choose a mix of both types.

Example Strategy:

-

Purchase a smaller whole life policy for lifetime needs.

-

Supplement with a larger term life policy during high-need years.

This approach provides:

-

Affordable large coverage now.

-

Guaranteed lifetime coverage later.

8. Common Myths About Term vs Whole Life Insurance

8.1 Myth: Whole Life Is Always Better Because It Builds Cash Value

Truth: While cash value is an advantage, the returns may be lower than other investments. Term may allow more flexibility in your financial plan.

8.2 Myth: Term Life is “Throwing Money Away”

Truth: Term life is pure protection — like home or auto insurance. The benefit is peace of mind, not investment returns.

9. How to Shop for Life Insurance Effectively

9.1 Get Multiple Quotes

Rates can vary greatly between insurers, so compare at least 3–5 quotes.

9.2 Understand the Fine Print

Check:

-

Coverage exclusions.

-

Conversion options (term to permanent).

-

Riders available (e.g., critical illness).

10. Expert Tips for Maximizing Value

-

Lock in coverage early while healthy to secure lower rates.

-

Consider term life for temporary needs and invest the difference.

-

Use whole life as part of a broader estate and tax strategy.

Conclusion: Making Your Choice Between Term and Whole Life Insurance

The term vs whole life insurance debate comes down to your priorities. If affordability and high coverage now are key, term life is likely your best bet. If lifelong protection and cash value growth matter more, whole life may be worth the investment.

Whatever you choose, the most important step is to take action — having some life insurance is always better than having none. Compare your options, assess your needs, and make a decision that protects your loved ones for years to come.